Standing Up for Homeowners Delivering Real Property Tax Relief.

Fair Property Tax Assessments

Advocating for accurate and equitable property valuations to ensure every homeowner pays their fair share.

Transparency and Accountability

Making the appeals process easy and accessible. Instituting a first of its kind Data dashboard, allowing residents to search appeal history/valuations by year and property type.

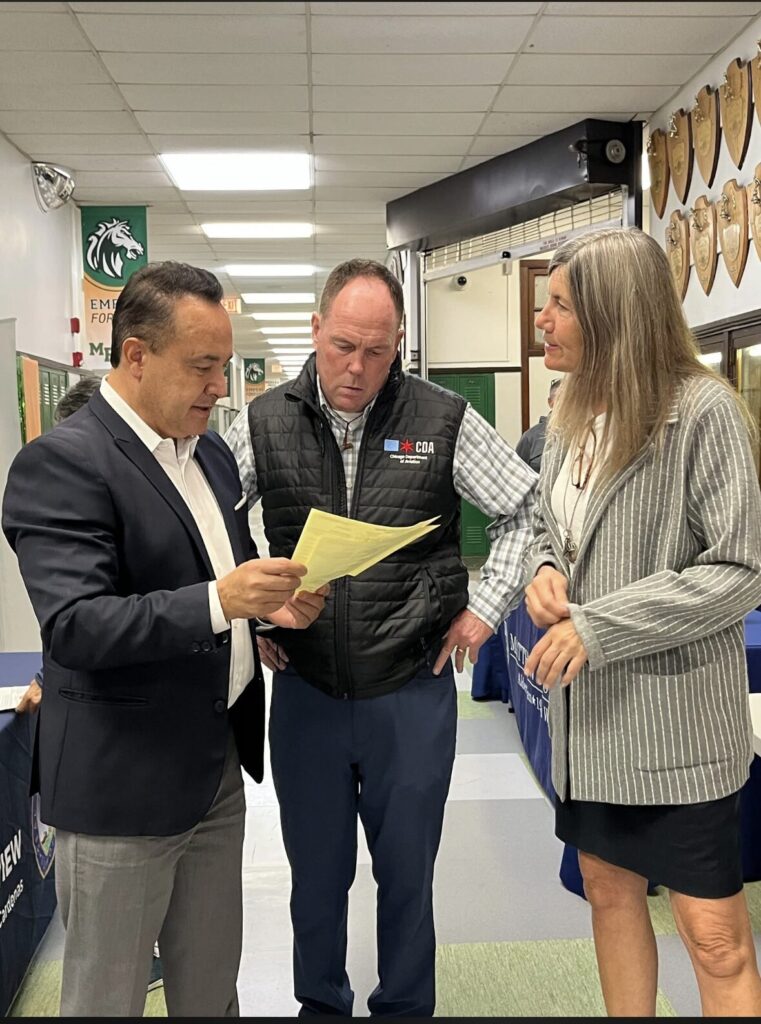

Community Engagement

Commissioner Cardenas has held hundreds of events over the past 4 years within the 1st District. Partnering with elected leaders to explain the appeals process, provide property tax relief to homeowners, and fix assessment errors.

George Cardenas: An Independent Voice Never Swayed By Political Pressures

George has spent his career fighting for working families. After spending 20 years as an Alderman on City Council, George ran for Board of Review Commissioner to give homeowners financial security in their property tax assessments.

Fair Property Valuation Reform

Granted to relief to homeowners in reassessment years when property taxes more than doubled by the Cook County Assessor.

Advocating For Taxpayers

When 2024 tax bills were late; Commissioner Cardenas re-opened townships after residents saw their bills increase. In order to make sure every taxpayer had a chance to appeal their assessment.

Changing The Property Tax System

Advocated for “circuit breaker” legislation in Springfield which would affect homeowners who have seen their property tax bill increase by over 50%. Allowing homeowners to receive a credit or partial payment of property taxes from the State of Illinois

Policy Change for Equitable Taxation

Participated in the Property Tax Reform Group, tasked with creating a more equitable, efficient, and transparent property tax system by addressing long-standing issues with assessment and appeals.